It was a very engaged crowd at the Five Dock library on 12 November. Everyone had a lot to say about the numerous complications that can arise when we get our affairs in order and prepare to simplify things for those people left behind.

It was a very engaged crowd at the Five Dock library on 12 November. Everyone had a lot to say about the numerous complications that can arise when we get our affairs in order and prepare to simplify things for those people left behind.

Category: legal issues

Home Care packages released ahead of schedule

National Seniors Australia (NSA) has welcomed the announcement that 20,000 new Home Care packages will be released ahead of the enaction of the new Aged Care Act on 1 November.

NSA Chief Executive Officer Mr Chris Grice said older Australians waiting for care, and their families, will welcome today’s news which sees the delivery of 40,000 packages up to the end of 2025 and another 43,000 within the first six months of 2026.

“NSA has been advocating for the immediate release of new packages to help begin the process of reducing the home care waiting list – we are glad to see compassion, care, and commonsense prevail,” Mr Grice said. “The release of new packages is recognition that we can’t delay reducing the wait list. It’s a down payment on providing care and support more quickly to older people who need it.

“One of the key recommendations from the Royal Commission into Aged Care Quality and Safety, more than four years ago, was that government should clear the home care wait list so that older people wait only one month for services. The release of new packages inches us closer to that goal.

“There is a question about what level these packages will be. We hope these are not only Level 1 packages, but include packages for people with higher care needs, particularly those stranded in the hospital system.

“The government will still have its work cut out for it to address the tens of thousands of older people waiting for care and waiting to be assessed for care, but the release of 20,000 packages is certainly a start.

“We must remember that it’s not only older people impacted by delays. It’s also loved ones, who provide the support when home care services are not available. “We hope and expect those most in need, including those stuck in hospital, will gain access to these new packages, allowing them to age at home, which is understandably their preference. “NSA thanks all generous individuals who shared their experiences, whose stories helped to shed light on the difficulties faced by older people waiting for care, and the challenges of the many loved ones supporting them. You have made a difference.”

Aged care reform in 2025: An agenda for the next Australian Government

As the first of the baby boomers turn 80 this year, the major parties are on a unity ticket sharing an ideological commitment to the private market and a commitment to make older people pay more for their aged care. Neither party has the details right.

Nearly four years on from the Aged Care Royal Commission, older people and their families are beginning to experience some improvements in the quality and safety of residential aged care. The Albanese government has substantially increased funding, a new funding model has largely stabilised the residential aged care sector and mandated staffing ratios and care minutes are leading to improved staffing and better quality care.

However, access to residential care has become much harder with public hospitals increasingly becoming default aged care providers caring for people waiting weeks to months for an aged care bed. This is having serious flow-on effects both for the older people left waiting for months as well as the medical and surgical patients who are not receiving the clinical care they need because of public hospital bed block.

A new Aged Care Act was introduced in 2024 and will take effect from 1 July 2025. The rights of older people are a central and welcome feature of the new Act.

But the Act is quite high level with the operational detail left to a set of subservient “Aged Care Rules”. Consultation drafts of the Rules have been progressively released as they are being written with comments closing on 13 May 2025. This is a bureaucratic process with no public accountability or oversight by the parliament.

Two months out from the Act taking effect, there are more than 700 pages of draft Rules, making it almost impossible for anyone to absorb them or provide a considered response. The final Rules are likely to be released only days before they take effect. Inevitably, things will go wrong.

While aged care residents will welcome the legislative commitment to their rights, two residential care changes will be less welcome. The first is a substantial increase in the fees and charges that residents will pay. Both major parties share a perception that the baby boomers are cashed up with the financial capacity to pay considerably more.

Indeed, the December 2024 mid year estimates budgeted for a massive $18.8 billion saving in aged care over the forward estimates to be achieved by substantially increasing how much older people pay for their care. This budget saving was supported by the opposition.

However, while many younger boomers may be cashed up, most older boomers are not and both major parties have ruled out touching the family home, which is the only asset for the majority of older people. The average age of entry to residential care is 85 years and only 13% of people 85 and older have more than $100,000 in superannuation. Further, two thirds of people entering aged care are women, who have significantly less superannuation than men. Charging aged care recipients $18.8 billion more in user charges may prove to be unachievable.

While there are protections for full and part pensioners, a typical self-funded retiree moving to residential care and paying a daily accommodation fee can expect to pay more than $120,000 per year in accommodation and care charges from 1 July 2025. There is a lifetime cap of $130,000 on non-clinical user contributions but no lifetime cap on accommodation charges.

The second significant change in residential care is the abolition of existing planning standards and bed licenses for residential care. The availability and location of residential care will now be left to the market with aged care providers effectively free to open and close homes wherever they chose.

The market, not the needs of older people, will determine what residential care will be available. Inevitably this will skew investment into wealthier areas at the expense of people living in lower socioeconomic areas.

However, there is now much more money to be made from investments in the retirement living sector than in residential care and the current aged care bed shortage will only increase as time goes on. This will inevitably result in longer waits and more public hospital bed block. Neither party has a plan for this.

In introducing the new Act, the government argued that less aged care beds will be required in future because more people want to receive their care at home. This makes no sense. It assumes that residential aged care is a lifestyle choice that is now going out of fashion. Older people do not go to residential care as a lifestyle choice. Older people move to residential care when they can no longer live safely at home.

This raises the obvious question about proposed changes to home aged care. There are currently 2.2 million people over 75 in Australia and 1.3 million (60%) currently receive aged care. Only 15% of people receiving aged care are in residential care, the other 85% receive care at home and in the community.

By far the majority of older Australians receiving care at home do not receive an “aged care package”. Instead, they receive services funded through the Commonwealth Home Support Program (CHSP). Each CHSP service receives an annual Commonwealth government grant and these services support 64% of all aged care recipients.

Services such as Meals on Wheels, community transport, neighbourhood day programs and community nursing are provided by not-for-profit community organisations as well as state and local governments and are all funded through CHSP. CHSP recipients are typically lower need and in most cases access services directly rather than through the Commonwealth “my aged care” gateway that channels people to the rest of the aged care system.

But both major parties have been on a unity ticket in running down CHSP in favour of a private for-profit market model known as community aged care “packages” and a growing percentage (currently 21%) of aged care recipients are now receiving a package. This is where the government allocates an older person a budget “package” to pay for their care. This allocation is in effect a cashless credit card earmarked for each individual person. There are currently 275,000 people receiving an aged care package and 85,000 people on the waiting list.

The current package system will be replaced from 1 July 2025 with a new package program called Support at Home. Support at Home differs from existing packages in having more funding levels, less flexibility and significantly higher user charges.

Hundreds of pages of the new Aged Care Rules are devoted to minutiae red tape and regulation about the Support at Home program. The design of the new program significantly increases the transaction and compliance costs for both government and providers, making Support at Home substantially more expensive and less efficient than CHSP. Inevitably these increased costs flow into higher charges for older people and their families as well as increase costs for the Commonwealth.

The 275,000 older people currently receiving a package will be protected from increases in user charges based on a government commitment to current package recipients being “no worse off”. While this is good politics, it further reduces the likelihood that the budgeted government savings will be realised.

This is not the case for those not already on a package. Anyone needing a package will be hit with a sizeable increase in fees and charges.

As just one example, anyone requiring personal care such as assistance with showering and dressing will be charged a co-payment. At an average hourly rate of about $100, full pensioners will pay $5 an hour, part-pensioners $5 to $50 an hour depending on income and self-funded retirees will pay $50 an hour. Fees for domestic assistance will be even higher indicatively ranging up to $76 an hour for self-funded retirees.

The original intention has been that the CHSP would be closed down with the 835,00 people receiving CHSP not for profit and government services being transferred to Support at Home in July 2025 as well. However, Minister Mark Butler announced in 2024 that CHSP would not transition to Support at Home until “at least 2027”.

Setting aside the issue of who pays for what, a key goal of home aged care is to reduce demand for residential aged care. This is where Support at Home is destined to fail. While the inclusion of access to nursing and allied health is welcome and evidence-based, the design of Support at Home ignores the international evidence about how to support older people to live in their own home for as long as possible. That evidence includes rapid response times without long waiting times, nimble and flexible services that can flex up and down in response to changing needs and adequate physical, social and emotional support for family carers. None of these essential features are incorporated into the design of Support at Home.

On the eve of the 2025 federal election, both major parties are on a unity ticket to deliver an aged care system that Australia can afford and that will meet the needs of the tsunami of baby boomers now moving into their 80s. However, both major parties have many details wrong.

The reforms since the Royal Commission have mostly been sensible. But the devil from here is in the detail. The design of the new Support at Home program and intentions to abolish the Commonwealth Home Support Program are not what the Royal Commission recommended and they will not meet the needs or the aspirations of older people. No sensible government would abolish an efficient program with one that costs substantially more, especially in the face of increased demand as the baby boomers reach old age. Yet that is what both major parties are mooting.

Meeting the needs of ageing baby boomers in ways that will not exacerbate intergenerational inequity must be a top priority for the next government. An investment in keeping older people healthy, along with a commitment to maintain and build on the strengths of CHSP, will be an essential first step.

While some older people are happy and capable of managing an aged care package in which their care is treated as a set of financial transactions, the majority of older people living at home want relationship-based care and support from people and organisations they know and trust. Going forward, a sustainable and affordable community aged care system must build on the expertise, culture and reputation of the not-for-profit sector in partnership with state and local governments.

As we move into the next phase of reform, people needing care at home must be given the option of receiving services from grant-funded not for profit providers or a cashless credit card to pay for their services in the private market, whichever they prefer. At the same time, there needs to a capital investment program to ensure that residential aged care is available to all those who cannot live safely at home.

While aged care has not featured in the 2025 federal election campaign, aged care is a sleeper issue for the next government. Older people, their children and their grandchildren represent a powerful political force in Australia. Bold reforms will be required during the next term of government to ensure that Australia’s aged care system is accessible to all who need it, affordable, safe and respectful. An Australian government that ignores aged care for too long does so at its peril.

Kathy Eagar

Seen at the Older Women’s Network Biscuit Day

Dying to know day was a lively event

COTA organised Dying to Know Day (August 8th) COTA under the auspices of North Sydney MP, Kylea Tink. NSW member and dying well advocate Jill Nash co-organised a fantastic line up of speakers to discuss Death, Dying and Grief.

COTA organised Dying to Know Day (August 8th) COTA under the auspices of North Sydney MP, Kylea Tink. NSW member and dying well advocate Jill Nash co-organised a fantastic line up of speakers to discuss Death, Dying and Grief.

Jill spoke poignantly about the loss of her baby daughter and then her husband when she was just 41. Informed by these traumatic experiences, Jill is taking control of her future by gathering information and documents and starting personal conversations now, so that her family are prepared for her death and dying when the time comes.

Alice Mantel, another COTA NSW member, also shared her specialist legal expertise on how to go about getting your affairs in order many years before you may think you will need to.

Alice is also the featured expert in the Planning for the Unexpected series produced by OWN NSW.

Over half a million older people experienced abuse in the last year

Latest data released by the Australian Institute of Health & Welfarehttps://www.aihw.gov.au/family-domestic-and-sexual-violence/population-groups/older-people#:~:text=In%20institutional%20settings%2C%20Yon%20et,and%20sexual%20abuse%20(1.9%25). (AIHW) has made some key findings that show people in Australia are at increased risk of abuse in their later years. This abuse can take many forms, including psychological or emotional abuse, financial abuse, physical abuse, sexual abuse, and neglect.

Key findings of the most recent data:

- 1 in 6 (15% or 598,000) people in Australia experienced elder abuse in the past year.

- psychological abuse is the most common form of elder abuse.

- 1 in 2 people who perpetrate elder abuse are a family member.

- 1 in 3 people who experienced elder abuse sought help from a third party.

As Australia’s population ages, the number of older people in Australia experiencing abuse is likely to increase over time. A key aspect of the definition is that elder abuse occurs in relationships where there is “an expectation of trust”. Such relationships include those with family members, friends, neighbours, and some professionals such as paid carers.

Prevalence estimates are likely to underestimate the true extent of elder abuse. This is because victim-survivors can be reluctant to disclose ill-treatment by a family member, or because they are dependent on the abuser for care. Older people with cognitive impairment (for example, dementia) or other forms of disability may also be unable to report abuse.

Evidence from international studies show that abuse estimates are higher for older people in institutional settings than in the community. A 2017 review found that there is a greater likelihood for women being abused (17%) than men (11%) with sons also more likely to perpetrate abuse than daughters.

What kind of abuse is perpetrated?

The AIFS National Elder Abuse Prevalence Studyhttps://aifs.gov.au/research/research-reports/national-elder-abuse-prevalence-study-final-report estimated that, in 2020:

- around 1 in 6 (598,000 or 15%) older people living in the community had experienced elder abuse in the past year

- 471,300 (12%) had experienced psychological abuse in the past year

- 115,500 (2.9%) had experienced neglect in the past year

- 83,800 (2.1%) had experienced financial abuse in the past year

- 71,900 (1.8%) had experienced physical abuse in the past year

- 39,500 (1.0%) had experienced sexual abuse in the past year

- a slightly higher percentage of women than men had experienced any form of elder abuse in the past year. This pattern was also evident for psychological abuse and neglect.

Who are the perpetrators?

Around 1 in 2 (53%) perpetrators of elder abuse were family members (includes ex-partner/spouses). Perpetration by family members was highest for financial abuse (64%) then neglect (60%), psychological abuse (55%), physical abuse (50%) and sexual abuse (15%). Sexual abuse of older people was primarily perpetrated by friends (42%), acquaintances (13%) and neighbours (9%).

Support for abused persons

The AIFS study estimated that:

- 1 in 3 (36%) older people in Australia who experienced abuse sought help or advice from a third party such as a family member, friend or professional;

- help seeking was most common after physical abuse, followed by psychological abuse, financial abuse, sexual abuse and then neglect;

- of those seeking help, the most common sources of help were family members (41%) and friends (41%), followed by a GP or nurse (29%), a professional carer (24%), the police (17%) and lawyers (15%). Around 1 in 20 (5.3%) contacted a helpline.

Around 8 in 10 (82%) older people who experienced abuse had taken action to stop the abuse from happening again. These actions included informal actions (such as speaking to the person) and formal actions (such as seeking legal advice). The most common actions were speaking to the person or breaking contact with them.

If you, or someone you know has been abused, you can call 1800 ELDERHelp.

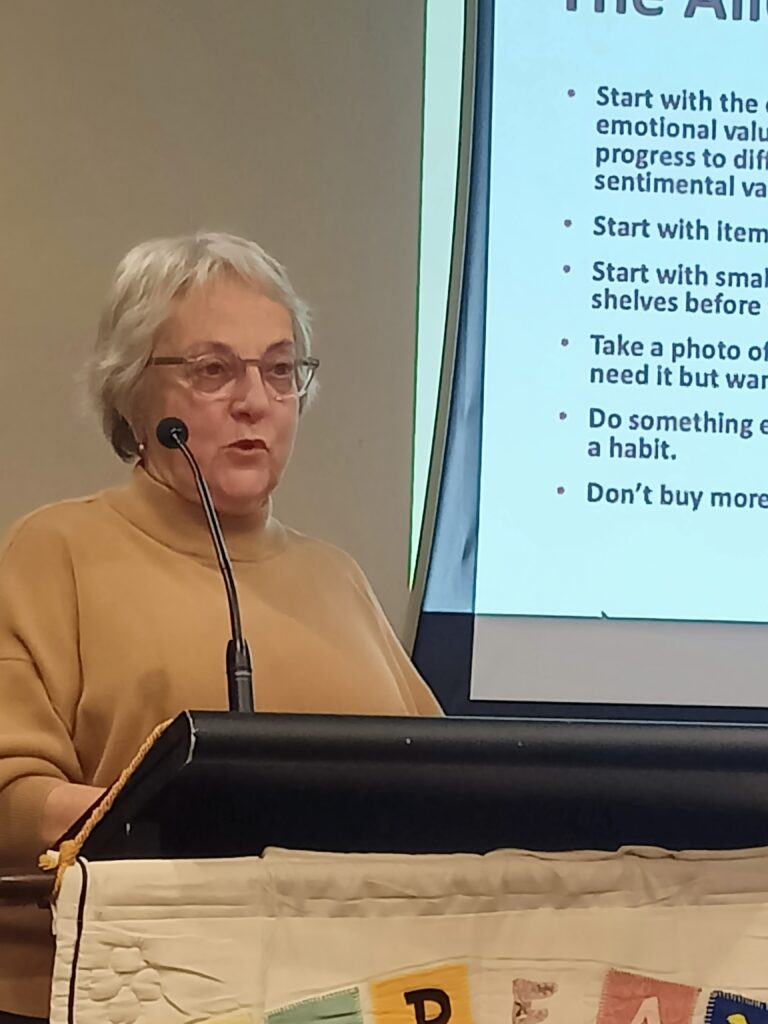

Decluttering – or the art of having less stuff.

Giving a talk at the Nepean-Hawkesbury VIEW Club on 17 June 2024.

Tune in to this series of podcasts – Planning for the Unexpected

Join me and my co-host Amanda Armstrong as we take you through this series of six podcasts which can help you to be better prepared for those unexpected life events.

Podcasts can be found on YouTube.

This series is presented on behalf of the Older Women’s Network.

Death is of course, inevitable, but often it is unexpected. Most of us would rather not think too much about it. But planning for the unexpected can be liberating. It allows you to enjoy life because you have removed a future burden for yourself and your loved ones.

This new series from OWN presented by family lawyer Alice Mantel will take you through what you need to organise before you die, from writing a will, family conversations and decluttering. It can be a baffling area, and easy to put in the too hard basket for now. This practical and reassuring series will break down the steps and give you tips to approach planning for the unexpected in a positive and proactive way.

Preparing for the unexpected – Wills, Power of Attorney, Enduring Guardianships and more – Episode 1.

The gentle art of decluttering – Episode 2

https://www.youtube.com/watch?v=C9TkNtu2WMA&pp=ygUacGxhbm5pbmcgZm9yIHRoZSB1bmV4cGVjdGU%3D

How is your financial health – Episode 3

Suddenly single – Episode 4

https://youtu.be/trNaxaNIjJA

Caring for elderly parents – Episode 5

Planning for the Unexpected: Finding Your Forever Home (or Downsizing made easy) – Episode 6

Ageing Australians increase demand for aged care services

As Australians are living longer than ever before, they are likely to experience greater frailty and more complex care needs requiring more aged care services.

Following the Royal Commission into Aged Care Quality and Safety report in 2021, it advised there was a need to significantly improve the quality of both residential and home care, exacerbated by chronic workforce shortages leading to substandard care. In 2023 the Aged Care Taskforce (the Taskforce) was established to advise on funding arrangements, including:

- a fair and equitable approach to assessing the means of older people;

- participant contributions for home care;

- reforms to arrangements for funding of hotel and accommodation costs in residential aged care, including the phasing out of Refundable Accommodation Deposits (RADs);

- services for inclusion and exclusion in the new home aged care program;

- funding and contribution approaches to support innovation in the delivery of care.

Issues affecting the aged care sector

The Taskforce identified the following issues affecting the aged care sector:

- demographic change means demand for aged care services will continue to grow;

- current and future generations of aged care participants have high expectations of what quality aged care looks like;

- generally older people are wealthier than previous generations and the taxpayer base is declining as a proportion of the population.

Demographic changes

The size of the population aged 65 and over is growing faster than the working age population. Over the next 40 years, the number of people over 80 years of age is expected to triple to more than 3.5 million. These demographic shifts have two critical implications:

• the taxation burden for funding aged care services grows for a segment of the population that is becoming proportionally smaller;

• gaps in the aged care workforce increase, creating significant ongoing challenges to delivering quality care.

Additional funding is needed to meet future demand and deliver quality improvements, but structural issues mean the sector’s financial viability is poor.

Superannuation shortfall

Income from superannuation should be drawn down in retirement to cover health, lifestyle, other living expenses and aged care costs. Superannuation, combined with high asset wealth through the family home and other investments, mean more people have accumulated wealth and income streams when they need to access aged care services. As a result, there is more scope for older people to contribute to their aged care costs by using their accumulated wealth than in previous generations.

It is important to note that, while the asset wealth of many older people has increased, there will be a group of people with less means. Even with the maturing superannuation system, over half of older people will continue to receive some Age Pension either at retirement or as they draw down on their superannuation. Past workforce participation rates also mean women are more likely to have less means in retirement, as are those who do not own their home.

Increase in demand for home care services

It is estimated that there will be almost 2 million older people using home care by 2042, compared with around 1 million currently. Consequently, the demand for home care has been rising sharply and is projected to continue growing well into the future. As a result, government spending on aged care as a proportion of gross domestic product (GDP) is projected to grow from 1.1% in 2021–22 to 2.5% in 2062–63.

More broadly, society is demanding higher quality aged care services for all, including participants supported by government. For example, research on public understanding and perception of co-contributions in aged care showed people are willing to pay more for home care services that are essential and increase quality of life and dignity.

Additional funding is needed to meet future demand and deliver quality improvements, but structural issues mean the sector’s financial viability is poor.

Aged care funding principles

Principle 1: The aged care system should support older people to live at home for as long as they wish and can do so safely.

Principle 2: Aged care funding should be equitable, easy to understand and sustainable.

Principle 3: Government is and will continue to be the major funder of aged care. Government funding should be focused on care costs as well as delivering services in thin markets. Personal co-contributions should be focused on accommodation and everyday living costs with a sufficient safety net.

Principle 4: The residential sector should have access to sufficient capital to develop and upgrade accommodation, including in rural and remote areas and First Nations communities.

Principle 5: Aged care funding should be sufficient to deliver person-centred, quality care by a skilled workforce.

Principle 6: Aged care funding should support innovation to improve aged care services and their relationship with the health and hospital systems.

Principle 7: There should be transparency and accountability for how aged care funding is received and spent while minimising regulatory burden.

Proposed changes

Home care funding

The new Support at Home Program will be implemented in 2 stages, replacing the current Home Care Packages Program from 1 July 2025 and then rolling in the Commonwealth Home Support Programme from no sooner than 1 July 2027.

Capital funding

Over the next decade to 2030, additional investment of approximately $5.5 billion would be required to refurbish and upgrade existing aged care rooms, increasing to $19 billion by 2050.7 Current funding arrangements will not deliver the required amount of capital funding.

Funding arrangements – reforming co-contributions

While the Taskforce supports government maintaining its central role in funding aged care, it does not support a specific increase to tax rates to fund future rises to aged care funding. There are substantial intergenerational equity issues in asking the working age population, which is becoming proportionally smaller to pay for these services. Moreover, superannuation has been designed to support people to grow their wealth and fund the costs associated with retirement including aged care.

There is a strong case to increase participant co‑contributions for those with the means to contribute, noting that there will always be a group of participants who need more government support.

Reforming co-contributions would also provide an opportunity to create a simpler and fairer system by addressing current inequities. The Taskforce suggests the Age Pension status of the participant, with some additional tiers for part-pensioners and non-pensioners, would be a fair and simple way to determine participant co-contributions for aged care services.

Phasing out Refundable Accommodation Deposits (RAD)

The Royal Commission (Commissioner Briggs) recommended phasing out of RADs over time and replacing them with income through a ‘rental model’, where everyone pays with non-refundable periodic payments, from July 2025.

The Royal Commission identified several issues with the RAD system that led to this recommendation:

• RADs and DAPs are not economically equivalent, which creates incentives for providers and older people to prefer one over the other.

• Use of RADs creates liquidity risks for providers, as the RAD must be refunded within 14 days of the resident leaving care. There is no guarantee the resident will be replaced by another RAD payer and, with falling occupancy rates, there is a risk they will not be replaced at all.

• The presence of RADs distorts access to finance towards providers better able to attract RADs.

• RADs are not a reliable capital financing mechanism for particular segments, such as providers in rural and remote areas.

Paying more towards accommodation will improve sustainability. This will attract increased investment into the sector to upgrade existing homes and build new homes with high quality, modern facilities.

Protections for low-income residents

Older people with limited means need to be protected. While the residential care proposals outlined above would improve the viability of the sector through improved co-contributions, they may make it more attractive for providers to seek out prospective non-supported residents in favour of government-supported residents.

For more details, see chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.health.gov.au/sites/default/files/2024-03/final-report-of-the-aged-care-taskforce_0.pdf

A fairer go for young people to reduce the generation gap

It’s a myth that young people’s spending habits and lifestyles are to blame for their stagnating wealth. This is not a problem caused by avocado brunches or too many lattes.

Today’s young Australians are in danger of being the first generation in memory to have lower living standards than their parents’ generation according to a 2019 report by the Grattan Institute., titled, Generation gap: ensuring a fair go for younger Australians .

According to the report, older Australians today spend more and have higher incomes and greater wealth than older Australians three decades ago.

But living standards have improved far less for younger Australians. The wealth of households headed by someone under 35 has barely moved since 2004.

Poorer young Australians have less wealth than their predecessors and are far less likely to own a home. In contrast, older households’ wealth has grown by more than 50 per cent over the same period because of the housing boom and growth in superannuation assets.

In fact, younger people are spending less on non-essential items such as alcohol, clothing, and personal care, and more on necessities such as housing, than three decades ago.

Economic pressures on the young have been exacerbated by recent wage stagnation and rising under-employment. Older households are better cushioned from low wage growth because they are more likely to have other sources of income.

If low wage growth and fewer working hours is the new normal in Australia, then we could have a generation emerge from young adulthood with lower incomes than the one before it at the same age. This has already happened in the US and the UK.

Young Australians will also bear the brunt of growing pressures on government budgets.

Because the population is ageing, governments will have to spend more on health, aged care, and pensions. But there will be fewer working-age people for every retired person to pay for it. The number of 15-64 year-old Australians for every person aged 65 or older fell from 7.4 in the mid-1970s to 4.4 in 2014-15 and is projected to fall further to 3.2 in 2054-55.

Governments have supercharged these demographic pressures by introducing generous tax concessions for older people. A subsequent Grattan report, Super savings: Practical policies for fairer superannuation and a stronger budget has suggested that tax breaks on superannuation are excessively generous and should be wound back to help fix the budget.

Super tax breaks cost the budget $45 billion a year – or about 2 per cent of GDP – and will soon exceed the cost of the age pension.

These tax breaks are not well targeted. Two-thirds of their value benefit the top 20 per cent of income earners, who are already saving enough for their retirement. Retirees with big superannuation accounts pay much less tax per dollar of super earnings than younger workers do on their wages.

The share of households over 65 paying tax has halved over the past two decades. And older households pay substantially less tax on the same income as younger households.

Working-age Australians are underwriting the living standards of older Australians to a much greater extent than the Baby Boomers did for their forebears, straining the ‘generational bargain’ to breaking point.

The report insists that policy changes are required. Policies to boost economic growth – such as tax reform, better education and smarter infrastructure spending – are wins for all, but especially for the young. Changes to planning rules to encourage higher-density living in established city suburbs would make housing more affordable. And a fair go for younger people means winding back age-based tax breaks for ‘comfortably off’ older Australians.

Just as policy changes have contributed to pressures on young people, they can help redress them. The time for action is now: none of us wants the legacy of a generation left behind.